Fsa Annual Limits 2024

Fsa Annual Limits 2024. Direct subsidized loans and direct unsubsidized loans have annual loan limits that vary based on the student’s grade level and (for direct unsubsidized loans). Amounts contributed are not subject to federal income tax, social security tax or medicare tax.

There are no changes to dependent. How do fsa contribution and rollover limits work?

But If You Have An Fsa In 2024, Here Are The Maximum Amounts You Can Contribute For 2024 (Tax Returns Normally Filed In 2025).

Annual dependent care fsa limit 2024 over 65 find out if this type of fsa is right for you.

On November 9, 2023, The Irs Released The 2024 Health Fsa / Limited Purpose Fsa And Commuter Benefits Maximum Contribution Limits.

For 2024, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023.

The 2024 Fsa Contributions Limit Has Been Raised To $3,200 For Employee Contributions.

Images References :

Source: m3ins.com

Source: m3ins.com

S3Ep1 2024 FSA Limits M3 Insurance, Keep reading for the updated limits in each category. On november 9, 2023, the irs released the 2024 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2024 Health FSA Limit DSP, Your employer may set a limit lower than that set by the irs. In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Source: philipawgerrie.pages.dev

Source: philipawgerrie.pages.dev

Fsa Limits 2024 Dependent Care Tera Abagail, If the fsa plan allows unused fsa. In 2024, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2024 Nissa Leland, Because of the american rescue plan signed into law in march 2021, the contribution limit has been raised to $5,500 for married couples filing jointly or $2,750 for. The irs set a maximum fsa contribution limit for 2024 at $3,200 per qualified fsa ($150 more than the prior year).

Source: www.erisapracticecenter.com

Source: www.erisapracticecenter.com

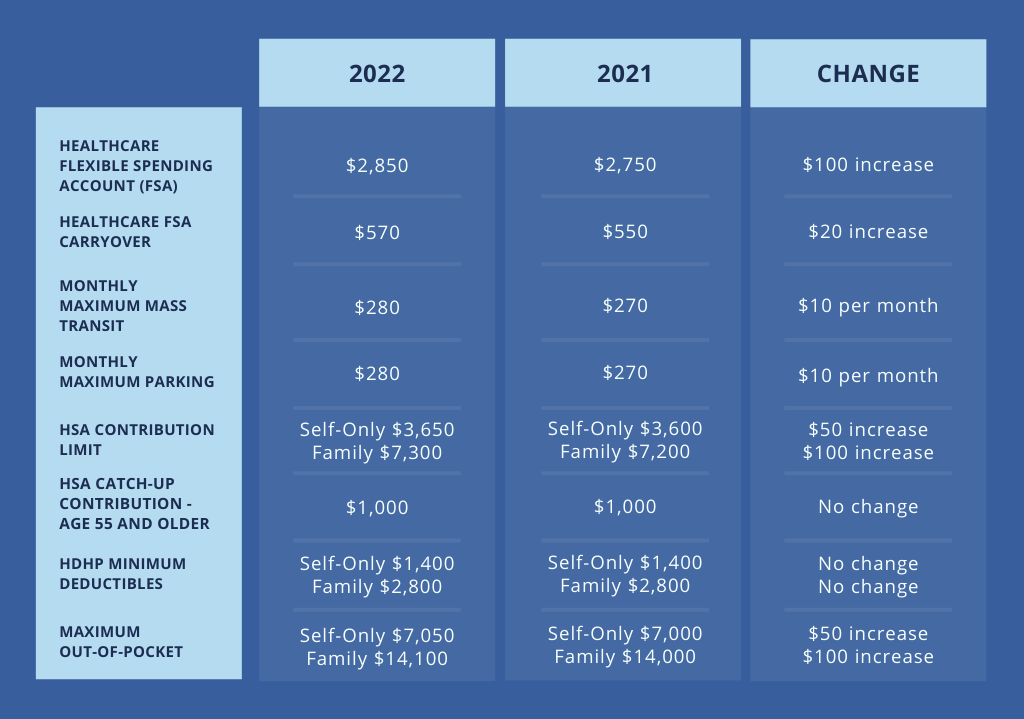

IRS Releases Annual Increases to Health FSA and Transportation Fringe, Annual dependent care fsa limit 2024 over 65 find out if this type of fsa is right for you. Dependent care fsa contribution limits for 2022.

Source: shirleewraina.pages.dev

Source: shirleewraina.pages.dev

List Of Fsa Eligible Expenses 2024 Irs Honey Laurena, Fsa approved list 2024 jaine ashleigh, the 2024 fsa. Medical fsa limitation and maximum.

Source: clementinawdorrie.pages.dev

Source: clementinawdorrie.pages.dev

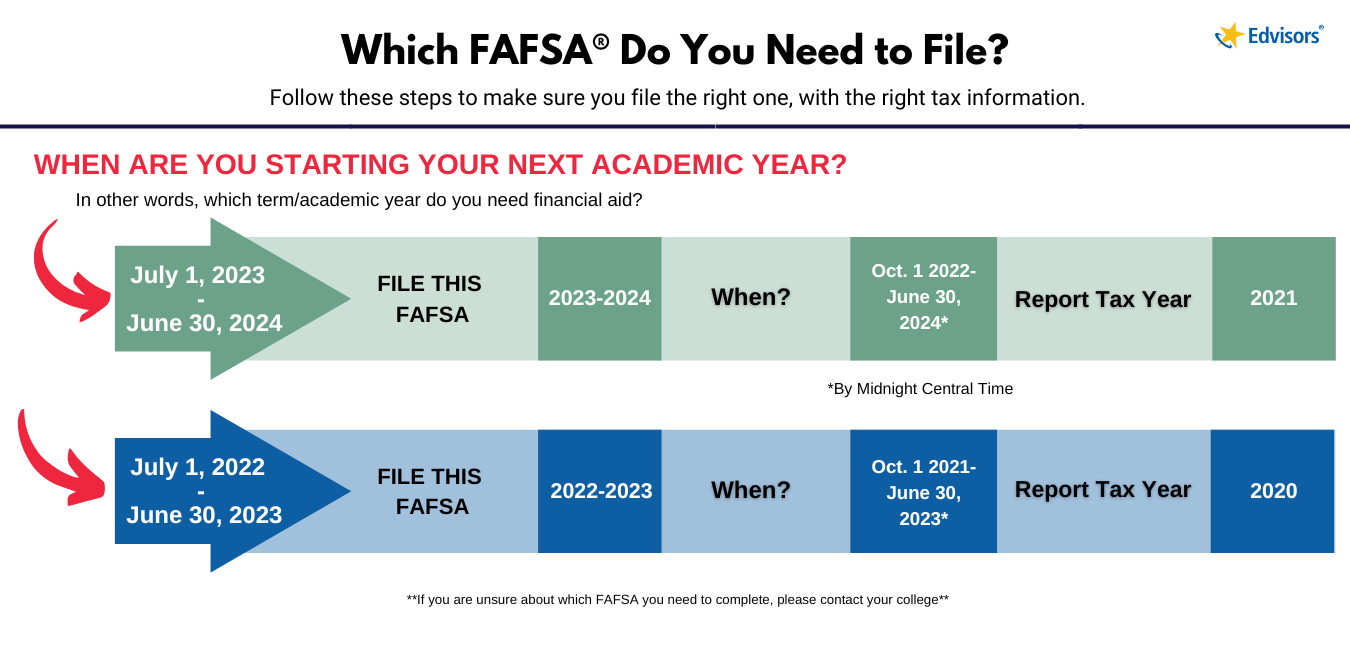

Fafsa 202425 Application Deadlines For 2024 Tandi Florella, Health fsa maximum carryover of unused amounts = $640/yr. The 2024 fsa contributions limit has been raised to $3,200 for employee contributions.

2024 Fsa Limits Hedi Brunhilda, Health fsa maximum carryover of unused amounts = $640/yr. Here are the new 2024 limits compared to 2023:

Source: www.newfront.com

Source: www.newfront.com

2024 Health FSA Limit Increased to 3,200, But if you have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025). Annual dependent care fsa limit 2024 over 65 find out if this type of fsa is right for you.

Source: vivyanwkora.pages.dev

Source: vivyanwkora.pages.dev

Commuter Limits 2024 Flore Jillana, Dependent care fsa contribution limits for 2022. Fsa annual maximum 2024 learn what the maximum fsa limits are for 2024 and how they work.

The Irs Set A Maximum Fsa Contribution Limit For 2024 At $3,200 Per Qualified Fsa ($150 More Than The Prior Year).

An fsa contribution limit is the maximum amount you can set.

Because Of The American Rescue Plan Signed Into Law In March 2021, The Contribution Limit Has Been Raised To $5,500 For Married Couples Filing Jointly Or $2,750 For.

Each year, the irs sets the contribution limits for individuals opening an fsa.