Home Office Expenses 2024 Rate

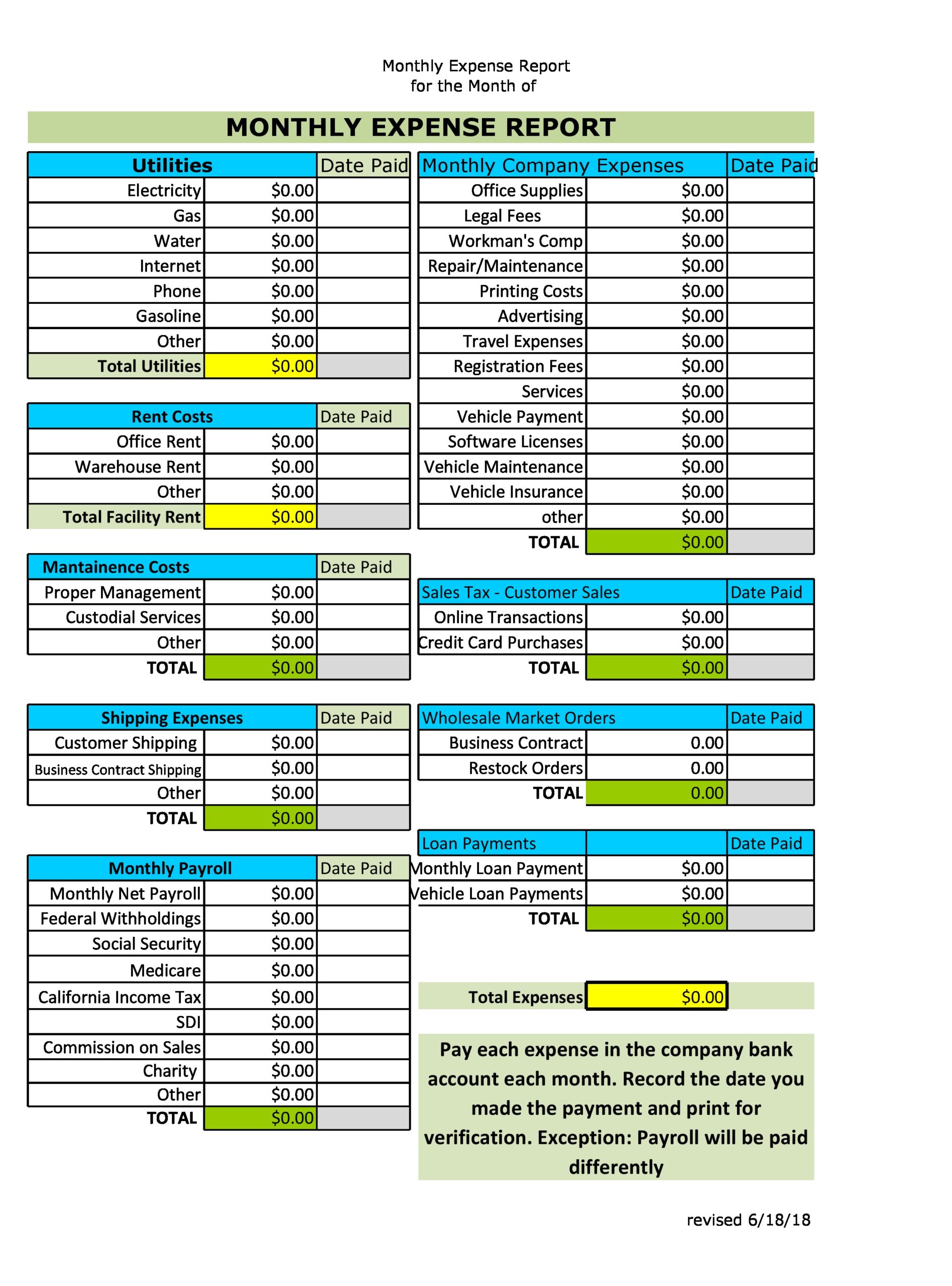

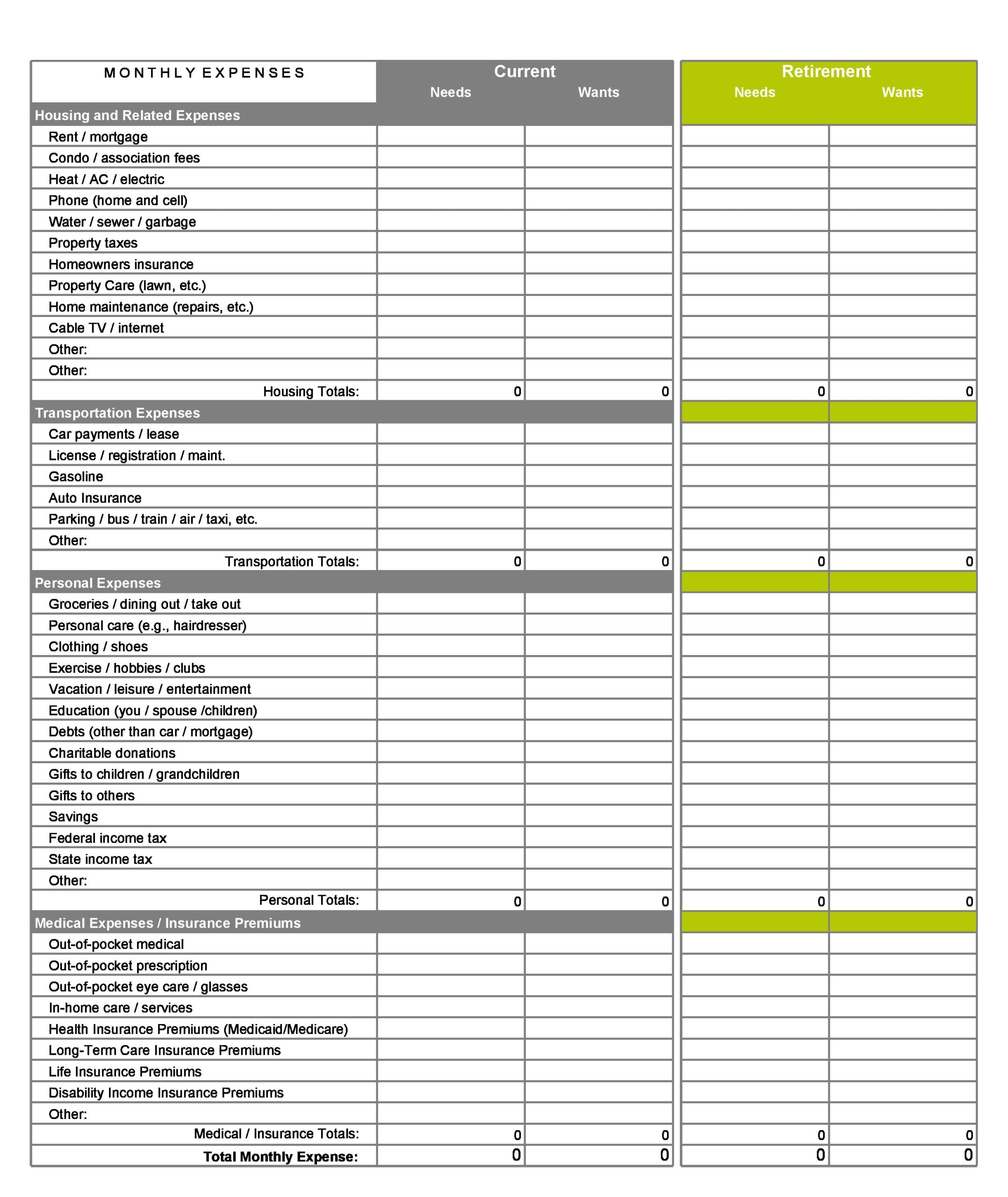

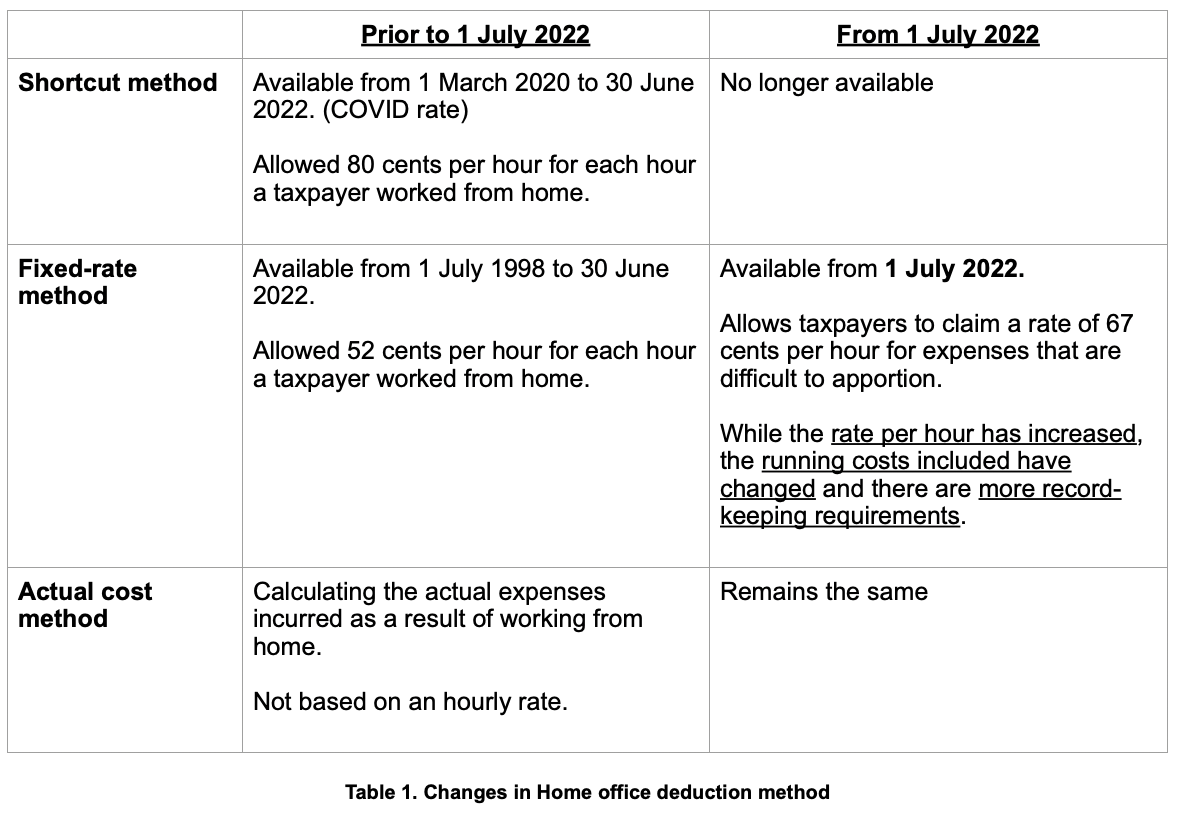

Home Office Expenses 2024 Rate. Under the new ‘fixed rate’ scheme, taxpayers will be able to claim 67 cents per hour worked from home, up from 52 cents. — this rate covers the additional running expenses that you incur as a result of working from home for energy expenses (electricity and/or gas), internet and data expenses, mobile and/or home phone usage expenses, stationery and computer consumables.

— from 1 july 2022 a new guideline provides for a revised fixed rate method with a deduction rate of 67 cents per hour, which can be used as an estimate of fair. The cost of cleaning your home office and repairing office furniture.

Home Office Expenses 2024 Rate Images References :

Source: templatebuffet.com

Source: templatebuffet.com

Home Office Expenses Excel Template Easily Track & Manage Your Costs, When does the new rate.

Source: societyone.com.au

Source: societyone.com.au

Home Office & Work From Home Expenses SocietyOne, You don’t need a separate home office or dedicated work area to use.

Source: terrijowbecca.pages.dev

Source: terrijowbecca.pages.dev

Home Office Expense Calculator 2024 ange maureen, — the temporary flat rate method is used to claim home office expenses that you paid like rent, electricity and home internet access fees, as well as office supplies.

Source: terrijowbecca.pages.dev

Source: terrijowbecca.pages.dev

Home Office Expense Calculator 2024 ange maureen, Methods to calculate your home office claim.

Source: alysiaqsidonia.pages.dev

Source: alysiaqsidonia.pages.dev

Home Office Expenses 2024 Jeri Rodina, If you don't use the fixed rate method, you need to use the actual costs method to claim a deduction for the additional expenses you incur.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Methods to calculate your home office claim.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/ORHPAY7LOZFBJL3FMRDCGN4X4A.jpg) Source: www.theglobeandmail.com

Source: www.theglobeandmail.com

How to claim home office expenses on your personal taxes as remote work, We acknowledge the traditional owners and custodians of country throughout australia and their continuing connection to land, waters and community.

Source: aileqkaitlyn.pages.dev

Source: aileqkaitlyn.pages.dev

Home Office Expenses 2024 Blank Calendar 2024, — the fixed rate method for calculating your deduction for working from home expenses is available from 1 july 2022.

Source: nexia.com.au

Source: nexia.com.au

Changes to home office deductions for 2023 Tax Returns Nexia Australia, You don’t need a separate home office or dedicated work area to use.

Source: boxas.com.au

Source: boxas.com.au

Home Office Expenses The Essential Guide BOX Advisory Services, Last updated 15 august 2024.