How Are Capital Gains Taxed In 2024

How Are Capital Gains Taxed In 2024. See how your investments will grow over time. We've got all the 2023 and 2024 capital gains tax.

See how your investments will grow over time. Last updated on april 23, 2024.

Your 2024 Capital Gains Bill Will Depend On 4 Main Things.

For the 2024 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

It's The Tax Applied On The Profit Gained From Selling Assets Like Stocks Or Real Estate That Have Been Held For A Longer Period, Typically Over A Year.

Capital gains tax rates for 2023 and 2024.

We've Got All The 2023 And 2024 Capital Gains Tax.

Images References :

Source: trudiqcathrine.pages.dev

Source: trudiqcathrine.pages.dev

2024 Capital Gains Tax Rates Alice Brandice, Chris wood, global equity strategist at jefferies, believes potential capital gains tax changes in the july budget pose a bigger threat to indian markets than the 2024 lok sabha elections. That’s up from $44,625 this year.

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

Capital Gains Tax Brackets And Tax Rates, Chris wood, global equity strategist at jefferies, believes potential capital gains tax changes in the july budget pose a bigger threat to indian markets than the 2024 lok sabha elections. Here's a breakdown of how capital gains are taxed for 2024.

Source: lorainewdyane.pages.dev

Source: lorainewdyane.pages.dev

Capital Gains Tax Law 2024 Jere Garland, Your 2024 capital gains bill will depend on 4 main things. Capital gains tax rates for 2023 and 2024.

Source: wrenqernesta.pages.dev

Source: wrenqernesta.pages.dev

Capital Gain Rates 2024 Irs Caril Cortney, Any profit or gain that arises from the sale of a ‘capital asset’ is known as. Last updated on april 23, 2024.

Source: taxrise.com

Source: taxrise.com

Capital Gains Tax A Complete Guide On Saving Money For 2023 •, Capital gains are the profit from selling an asset, such as a stock, mutual fund, or etf. The tax rates remain the same for the sale of investments and assets that grow in value,.

Source: timotheawjeana.pages.dev

Source: timotheawjeana.pages.dev

Long Term Tax Rate 2024 Daisie Lorrayne, You may owe capital gains taxes when you realize capital gains by selling an asset. 1) the amount your investments have increased in value.

Source: www.financestrategists.com

Source: www.financestrategists.com

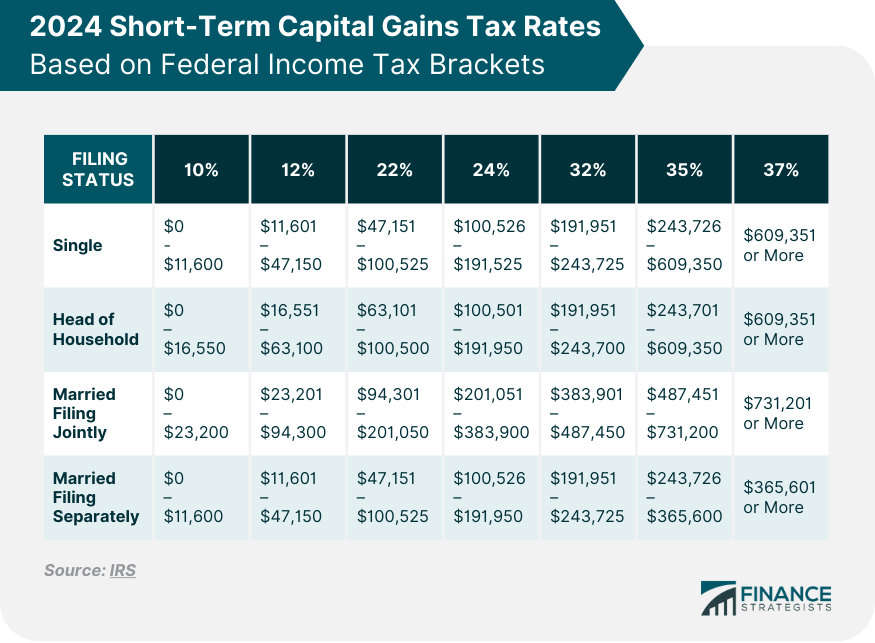

Capital Gains Tax Rate 2024 Overview and Calculation, The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held the. It is important to note that taxes are.

Source: fiannqshanie.pages.dev

Source: fiannqshanie.pages.dev

Capital Gains Tax Rate 2024 Dredi Ginelle, We've got all the 2023 and 2024 capital gains tax. 2) how long you held the investments you sold.

Source: www.harrypoint.com

Source: www.harrypoint.com

ShortTerm And LongTerm Capital Gains Tax Rates By, We've got all the 2023 and 2024 capital gains tax. For the 2024 tax year, the highest possible rate is 20%.

Source: kindnessfp.com

Source: kindnessfp.com

Capital Gains vs. Ordinary The Differences + 3 Tax Planning, If these tokens increase in value and are later sold or exchanged, the profit earned from that transaction will also be taxed at the same 30% rate. For the 2024 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

Should You Rent Or Buy?

For the 2024 to 2025 tax year the allowance is £3,000, which leaves £9,600 to pay tax on.

See How Your Investments Will Grow Over Time.

If you have cashed out capital gains in new york, you know you’ll lose something to taxes.