Irs Tax Credit Electric Car 2024

Irs Tax Credit Electric Car 2024. Department of the treasury and internal. The tax credit extends through dec.

Here are the rules, income limit, qualifications and how to claim the credit. The $7,500 tax credit program for electric car purchases is getting stricter next year, as it will for the next several years to come.

Federal Incentives Include A 30% Tax Credit Up To $1,000 For Electric Car Chargers And Installation Costs.

The irs has made the ev tax credit easier to obtain, and in 2024 it’s redeemable for cash or as a credit toward the down payment on your vehicle.

The Ev Tax Credit Is A Federal Tax Incentive For Taxpayers Looking To Go Green On The Road.

The qualifying rules became stricter in 2024, which is why the list of eligible evs got smaller.

All Evs That Qualify For The Federal Tax Credit Right Now.

Images References :

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The credit is available to. In 2024, several evs are eligible for the federal government's tax credit program, which can reduce what you owe the irs by up to $7500 for a single tax year.

Source: www.autopromag.com

Source: www.autopromag.com

Here are the cars eligible for the 7,500 EV tax credit in the, In 2024, several evs are eligible for the federal government's tax credit program, which can reduce what you owe the irs by up to $7500 for a single tax year. Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs.

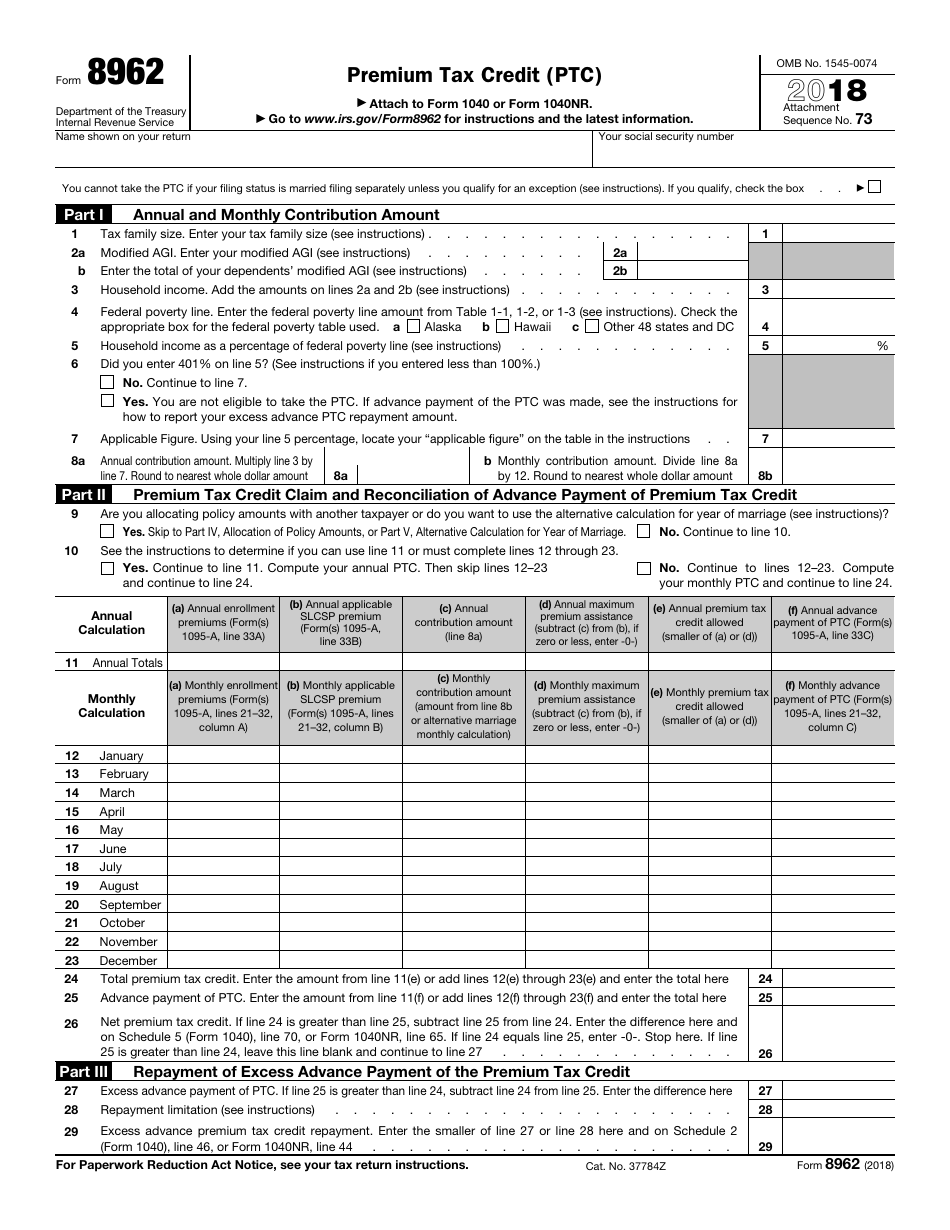

Source: templates.esad.edu.br

Source: templates.esad.edu.br

Form 8962 Printable, A hefty federal tax credit for electric vehicles is going to get easier to. The good news is the tax credit is now easier to access.

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 1040 Schedule 8812 Download Fillable PDF or Fill Online, All evs that qualify for the federal tax credit right now. The irs has made the ev tax credit easier to obtain, and in 2024 it’s redeemable for cash or as a credit toward the down payment on your vehicle.

Source: www.trendradars.com

Source: www.trendradars.com

IRS officially updates its EV tax credit rules, cutting out even more, Here are the rules, income limit, qualifications and how to claim the credit. What to know and how to qualify a guide on how to qualify for up to $7,500 in tax savings.

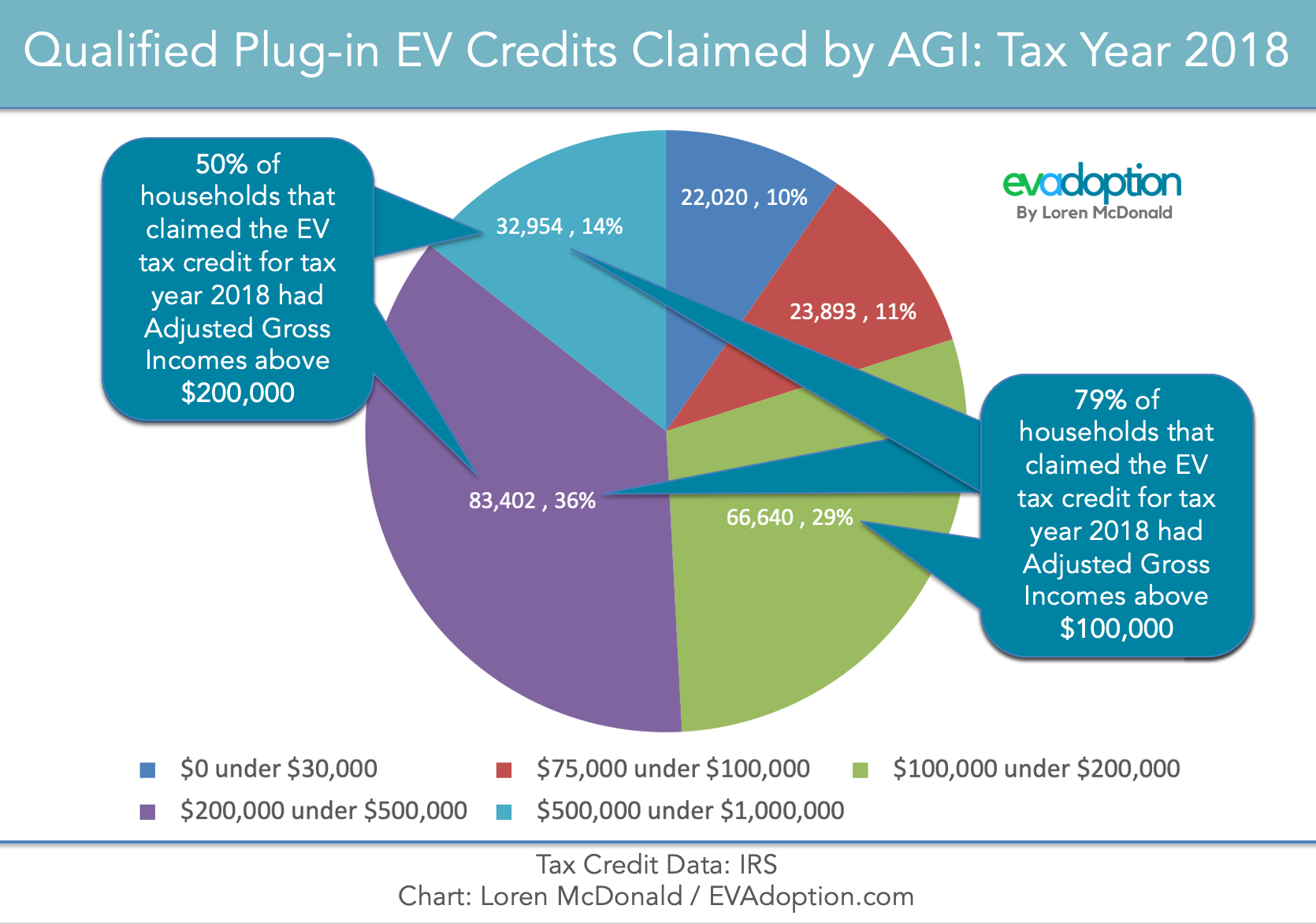

Source: evadoption.com

Source: evadoption.com

IRSTaxcreditbyHouseholdAGI2018updated EVAdoption, The qualifying rules became stricter in 2024, which is why the list of eligible evs got smaller. Which electric cars get a tax credit for 2024?

Source: www.ibtimes.sg

Source: www.ibtimes.sg

Art and Cosmetic Industries Are Benefiting from 'IRS Tax Credit Pros', In 2024, several evs are eligible for the federal government's tax credit program, which can reduce what you owe the irs by up to $7500 for a single tax year. If you are considering buying an electric car in 2024, there's good news — and bad news:

Source: federaltax.net

Source: federaltax.net

Internal Revenue Service Wiki Federal Tax, The irs has made the ev tax credit easier to obtain, and in 2024 it’s redeemable for cash or as a credit toward the down payment on your vehicle. Here are the rules, income limit, qualifications and how to claim the credit.

Source: printableformsfree.com

Source: printableformsfree.com

Form 8911 For 2023 Printable Forms Free Online, The tax credit extends through dec. Here's what you need to know.

Source: alloysilverstein.com

Source: alloysilverstein.com

Frequently Asked Questions 2023 Clean Energy and Electric Vehicle Tax, The irs has made the ev tax credit easier to obtain, and in 2024 it’s redeemable for cash or as a credit toward the down payment on your vehicle. Federal incentives include a 30% tax credit up to $1,000 for electric car chargers and installation costs.

The Bad News Is Fewer.

1, 2024, eligible buyers can choose between getting an instant ev tax rebate to use as a down payment on qualified new or used vehicles at the time of.

Which Electric Cars Get A Tax Credit For 2024?

If you are considering buying an electric car in 2024, there’s good news — and bad news: