Maximum Ira Catch Up Contribution 2024 Calculator

Maximum Ira Catch Up Contribution 2024 Calculator. If you're age 50 and older, you. You can make 2024 ira.

The annual roth ira contribution limit in 2023 is $6,500 for adults younger than 50 and $7,500 for adults 50 and older. The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500.

Maximum Ira Catch Up Contribution 2024 Calculator Images References :

Source: tobiyovonnda.pages.dev

Source: tobiyovonnda.pages.dev

Ira Catch Up Contribution Limits 2024 Carry Crystal, The limit for annual contributions to roth and traditional individual retirement accounts (iras) for the 2023 tax year was $6,500.

Source: atheneyrozina-3dp.pages.dev

Source: atheneyrozina-3dp.pages.dev

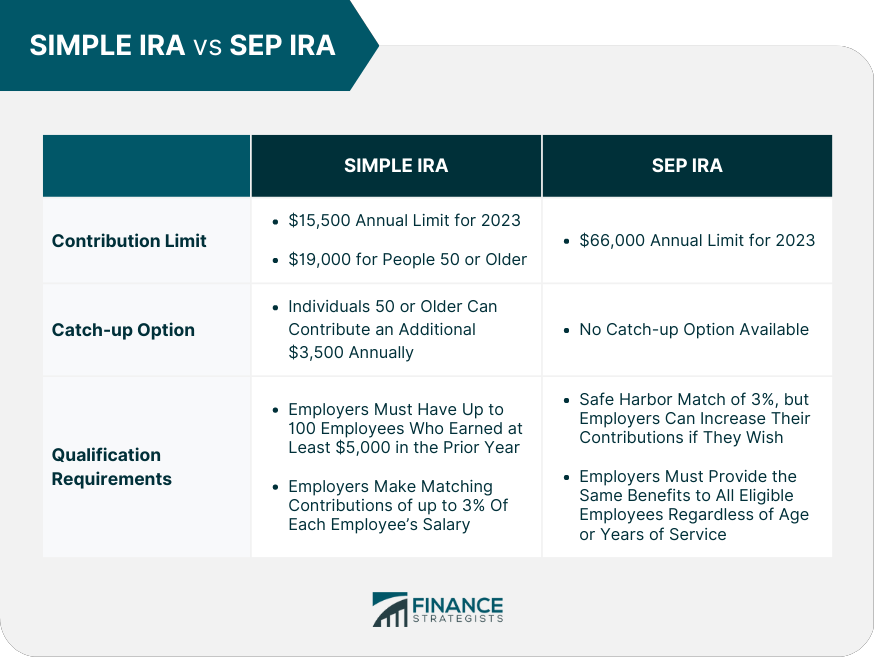

Simple Ira Catch Up Contribution Limits 2024 Tony Ursola, $13,500 in 2020 and 2021;

Source: graceyberenice.pages.dev

Source: graceyberenice.pages.dev

Ira Catch Up Contribution Limits 2024 Ivory Letitia, Ira contribution limits for 2024.

Source: kalieyviolette.pages.dev

Source: kalieyviolette.pages.dev

2024 Roth Ira Contribution Limits 2024 Catch Up Hanna Lucina, This is an increase from 2023, when the limits were $6,500 and $7,500,.

Source: oliveyfelicle.pages.dev

Source: oliveyfelicle.pages.dev

Maximum 401k Contribution 2024 Calculator Fredi Rennie, Those aged 50 and older can contribute an additional $1,000 as a.

Source: birgitbverene.pages.dev

Source: birgitbverene.pages.dev

Max Sep Ira Contribution 2024 With Catch Up Limit Dona Nalani, For 2024, the contribution limit is $7,000 (plus the.

Source: deloracristin.pages.dev

Source: deloracristin.pages.dev

2024 401k Contribution Limit Calculator Amii Lynsey, This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose.

Source: honeyterrie.pages.dev

Source: honeyterrie.pages.dev

Maximum Ira Catch Up Contribution 2024 Halli Kerstin, This is an increase from 2023, when the limits were $6,500 and $7,500,.

Source: karolqwaneta.pages.dev

Source: karolqwaneta.pages.dev

401k Catch Up 2024 Contribution Limit Irs Bren Marlie, $13,500 in 2020 and 2021;

Source: graciaykatharine.pages.dev

Source: graciaykatharine.pages.dev

Roth Ira Contribution Limits 2024 Capital Gains Tax Sadye Conchita, The ira calculator can be used to evaluate and compare traditional iras, sep iras, simple iras, roth iras, and regular taxable savings.